Vigilant Of Second Round Effects

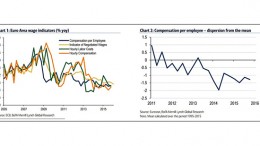

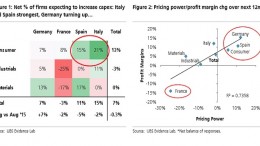

BoAML | We have remained quite bearish on Euro area inflation for the past few years, particularly compared with ECB forecasts (but also consensus), and have highlighted the many downside risks to the inflation outlook.