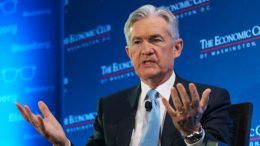

Fed chairman confirms policy rate spike but will not cut rates until confident inflation is close to 2%

BancaMarch: Federal Reserve Chairman has confirmed the peak in official interest rates. Jerome Powell, has kept his January speech unchanged, indicating that monetary policy will change course at “some point this year”, without specifying a date. He also emphasised the risks of bringing forward the cuts too soon, resulting in a return of inflation and the need for an even tighter policy. Thus, the Fed will not cut rates until…