ECB joins the warning: beware of cheap debt

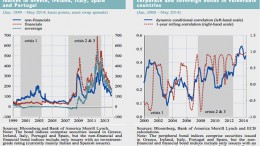

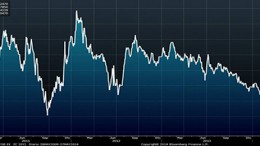

MADRID | By The Corner | As the Spanish sovereign bond is at minimums (2.8%) and the volume of debt has attained maximums (98%), Bankinter analysts point that low rates along with the large volume of issuances make European fixed income highly sensitivity to the risk premium ups and downs. High yield European firms are placing their bonds at historical minimum of 3.73%, when the average of the last 15 years is 10.19%. One of the risks the ECB is highlighting is the return of financial instruments that boosted banks’ leverage and resulted in the 2007 economic downturn.