ECONOMY

The EU Will Not Grant London Unlimited Access To European Financial Markets

Impact Of Coronavirus On Fixed Income

By Kevin Flanagan, (Head of Fixed Income Strategy, WisdomTree) / This year has got off to an unusual start in the financial markets. Typically, the focus would be on the Federal Reserve (Fed) and/or economic developments, but unfortunately the coronavirus has taken centre stage. I thought it would be useful to offer some insights from a bond market perspective, using the SARS (Severe Acute Respiratory Syndrome) outbreak of November 2002 to July 2003 as a comparative event.____¨

Stock Markets Remain Vulnerable To Short-Term Correction

The People’s Bank of China pumps 1.2tn yuan into the financial system to protect the economy from the coronavirus Global stocks extended their rally last week despite concerns that the coronavirus will slow global growth. Experts at Julius Baer continue to argue that stocks are susceptible to a short-term correction and consider any weakness as an entry opportunity for long-term investors.

Gold: Tossed And Torn By The Virus

As investors are still struggling to properly price the impact of the coronavirus, volatility in financial markets remains elevated. Risk-on sentiment returned to the markets yesterday, putting pressure on gold. Barring a longer-lasting impact on Chinese growth, we do not expect much more fundamental short-term support from the virus for gold. However, on a longer-term horizon we still see upside and maintain a Constructive view.

The Chairman Of REE Resigns Because Of Disagreements With The Government

According to articles in the press, the decision of Jordi Sevilla, president of REE (Red Eléctrica de España) responds to his growing disagreements with Teresa Ribera, one of four vice presidents of the Government and Minister for Ecological Transition.

Economy At A Glance: The Bank Of Spain Forecasts

Círculo de Empresarios | The Bank of Spain forecasts that the Spanish economy will embark on a gradual path of deceleration until 2022, and therefore maintains its 2% and 1.7% annual growth forecasts for 2019 and 2020, respectively.

Emerging Markets Debt Is A Good Asset Class To Weather Slowing Global Growth

Alejandro Arevalo (Jupiter’s Head of Strategy, Emerging Markets) | One might think that emerging market debt has had difficult year, but it’s been quite the opposite. At the time of writing, the major EM hard currency indices have all returned more than 11% year to date.

Sharing Economy: Europe Gives Guidance

Julius Baer Research | | Marketplace companies active in the Sharing Economy such as Uber and AirBnB (both not listed) are combining social networks, Big Data analytics and mobile accessibility. Last week, the European Commission (EC) issued guidelines to harmonise the often wildly different treatment faced by businesses trying to shake up sectors ranging from accommodation to transport across the Eurozone.

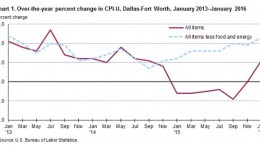

No Inflation In Texas: A Lesson There?

Benjamin Cole via Historinhas | It is too bad in some regards that Richard “Inspector Clouseau” Fisher, the former president of the Federal Reserve Bank of Dallas, in no longer ensconced in that position. For one, he was always great copy. For seconds, he was one of the most infallible reverse indicators of Post War Era, and economic soothsayers could bet against a Fisherian proclamation with a rare calm.