UK Budget: Deja-Vu, All Over Again

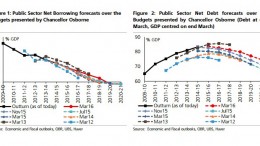

The Chancellor’s latest Budget saw the cumulative forecast for government borrowing over the next five years revised up by close to GBP 40bn. This reflects both weaker cyclical growth and also the Office for Budget Responsibility (OBR) taking a gloomier view on UK trend productivity growth.