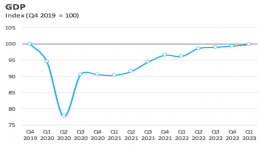

US GDP rises 1.6% between January and March, boosted by services consumption

Intermoney| As expected, imports subtracted from GDP, which was expected given the trade deficit. The trade drag took 0.86 p.p. off the growth rate. Paradoxically, strong imports reflect solid consumer demand, but they also detract from overall GDP growth. That is the trade-off. Net exports only grew by +0.9% quarter-on-quarter, which shows that a strong dollar seems to put some pressure on exports. Also note that inventories built up at…