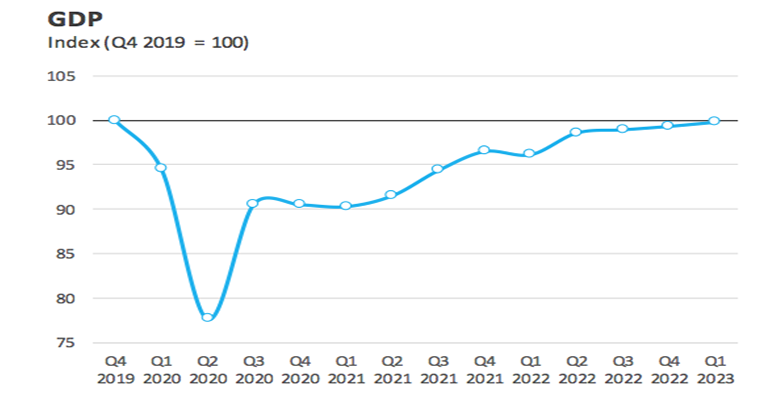

Miguel Navascués| Although domestic demand has been in decline for two quarters, the recovery in tourism (whose revenues grew 38% year-on-year in 1Q23) and exports (+14%) have finally allowed Spain to recover its pre-Covid GDP in 2Q23. It is the last eurozone country to achieve this (while neither the Czech Republic nor Japan have yet done so) two years later than the average of the 19 most significant euro countries.

This is not a great triumph, but rather a small failure, backed up by the widening of the GDP per capita gap between Spain and the eurozone: from a low of 11% in 2005 to the current 17%.

It has also been a growth that is doped by a very expansive fiscal policy, financed by a worrying increase in spending and public debt. Consolidated official public debt, i.e. once the discounts of the so-called EU Excessive Deficit Protocol are taken into account, has increased from the end of 2018 to the end of 2022 by €300 billion. If we were to add the €70 billion subtracted by the EDP method, it would be €370 billion, at €93 billion per year.