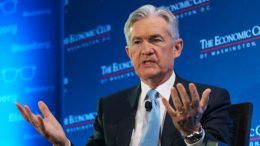

US: Fed shifts rate cut outlook from 2024 to 2025 and 2026 as CPI falls to +3.3% in May

Bankinter: The Fed meets expectations and keeps interest rates (Fed Funds) at 5.25%/5.50%. With respect to the macro picture, it maintains the GDP forecasts for 2024, 2025 and 2026. However, it revises upwards both Inflation (PCE) and Underlying Inflation in 2025 and 2026 and continues to miss the 2% target until 2026. The Unemployment Rate is also revised slightly upwards in 2025, 2026 and in the longer term. With regard…