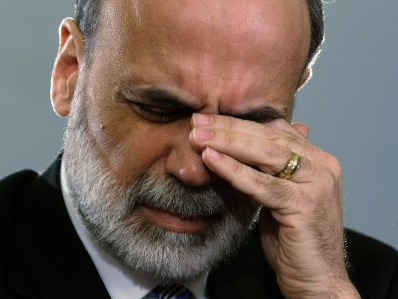

When it comes to money, one can get really FED up

By Juan Pedro Marín Arrese, in Madrid | Markets around the world are flooded with huge loads of fresh cash pumped in by central banks. The balance sheets of central banks have tripled since 2008. And yet monetary supply is lagging behind. Don’t put the blame on banks. Their assets are shrinking as a result of the massive reshuffle in credit exposure undertaken by enterprises and individuals. A grim outlook is…