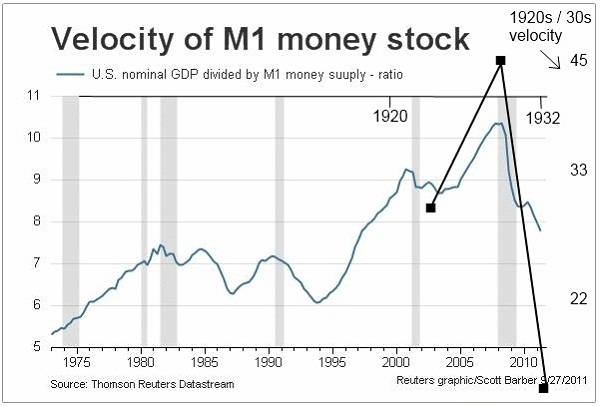

By Luis Arroyo, in Madrid | The Ralphanomics blog has a post on velocity of circulation of money that brings a very interesting intuitive graph: how the velocity of money (M1) has changed since the crisis began. Against this variable, there is a comparison to the 1930s Great Depression –the black line at the right angle, between 1920 and 1932. The velocity of money is simply the GDP divided by money in circulation. The more GDP per volume of money, the faster money circulates. During booms, money becomes optimistic and circulates with great confidence, while in depressions everyone cherishes it and it circulates more slowly. Speed is an indicator of the demand for money, of how people prefer to spend or retain money. The greater the speed, the demand for money lessens and vice-versa. When V increases, the central bank reduces the amount of money to temper the excesses and when the velocity decreases, the reverse. This is what Milton Friedman proposed in 2003, calling V the “Thermostat“.

As shown, the speed increased after the 2000-03 recession until the current crisis exploded, and has fallen ever since. The overlap of what V registered in the Great Depression and indeed how deeply it fell, tells us what we should avoid at all costs. How? When V falls, as in the equation, the M should rise so that the level of transactions and prices will not fall. This is when the central bank must increase its liquid liabilities (money) by purchasing and upping its assets. It must remove illiquid assets in exchange for cash to re-establish the balance in the money market and get people to spend again.

This is what the European Central Bank (ECB) refuses to do and what the Federal Reserve is coerced into not doing by the appalling threats of the Republicans who do not want the economy to heal before they reach the White House –something they say almost shamelessly. They know their best hope is that unemployment rise and the economy get stuck. That would almost certainly drag Obama down. As we see in the graph, allowing V to drop too much can have huge consequences, from a recession to a depression. These consequences are even more serious when their environment is a collapsed banking sector exacerbated by a fall in V (Scott Sumner and Marcus Nunes would say caused precisely by the fall of V).

In all honesty, ours is such an intricate environment… but in any case, the first thing that must be done is restoring the money volume needed by agents, to improve spending and normalise V. First things first, then: we must encourage, in any possible way, growth; this will enable us to fix the debt gap.

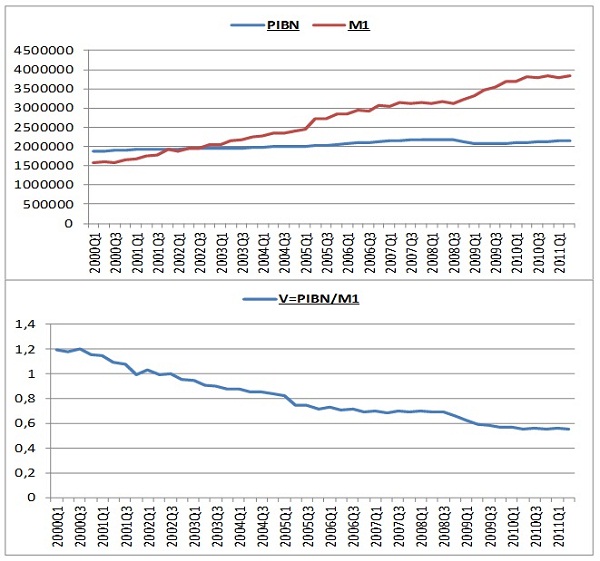

In the euro zone, I have used M1 and nominal GDP. Below, the resulting V. Between the end of 2006 and recent days, the speed of V circulation has lost strength from 1.1 to 0.59. With this data and taking in account the extreme travails we are going through, the ECB should increase the money supply. To do the opposite –which has already been proven– and contain growth until debts are paid back, will lead us to a disaster.

Luis Arroyo is a former Bank of Spain economist. He writes for www.consensodelmercado.com.

Be the first to comment on "Circulation velocity of money, from 1.1 to 0.59: it's big time the ECB, Fed react"