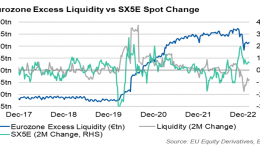

Eurozone liquidity falls 12% in three months

Morgan Stanley analysts explain that excess liquidity in the European market multiplied in the post-Covid phase: from €1.7tn in December 2019 to a peak of €4.8tn in September 2022 and this increase helped stabilise the equity market during 2020. But “in the last three months we have seen this excess liquidity reduce by -12% (part of the ECB’s plan, by ending APP reinvestments and reducing TLTROs)