Tea-partisans are ready to not approving the 2014 budget so that they can freeze the debt ceiling again. This would lead to the pressing need to close some items of expenditure in order to adjust them to the current income –which would entail a contraction of around 4% of GDP, Mr Krugman estimates.

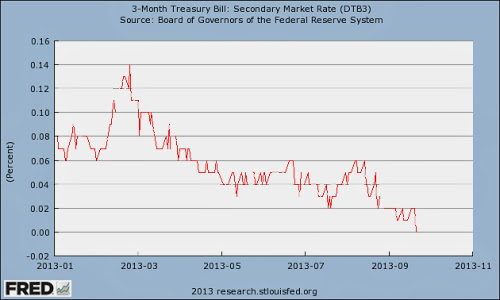

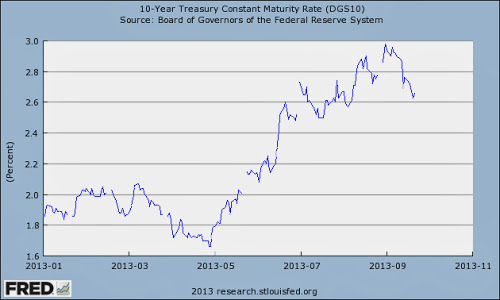

Why is it that markets have not reacted to something that will allegedly unleash disorder and chaos? Well, as a matter of fact, they did react –and, as Mr Krugman said, they reacted in the opposite direction to the expected. Bill and bond interest rates have dropped in relatively quickly.

What everyone stresses is that U.S. government debt, until now regarded as the ultimate safe asset, suddenly becomes not so safe. That could drive up short-term interest rates, at least a bit, because T-bills could start to trade at a discount relative to cash. Although maybe not. Is there a reason the Fed can’t serve as bond buyer of last resort, standing ready to buy T-bills at par, so they remain fully liquid?

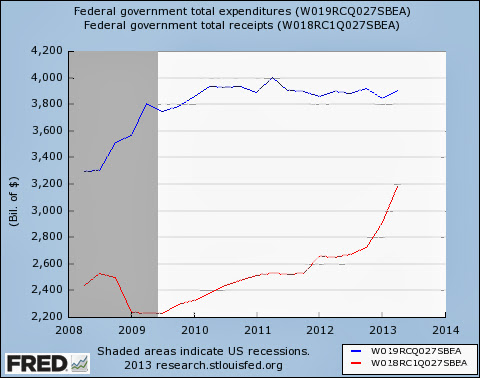

If the feds are forced to slash spending, one way or another (and probably semi-randomly) to match receipts, that’s about $600 billion in cuts at an annual rate, or 4 percent of GDP. That’s a huge case of unintended austerity, quite aside from the disruptions, surely enough to push us back into recession if it lasts for any length of time.

And a double-dip recession would, in turn, push back the date of Fed rate increases far into the future, which would normally cause a big drop in long-term rates.

So I’m not at all sure that we’re looking at an interest rate spike; maybe even the opposite.

But for sure we should be looking at a plunging dollar, and probably carnage in the stock market too.

As the following charts show, markets are now on a downward trend. Furthermore, they forecasted that FED would –undoubtedly- delay the moment of finishing the QE and expand its provision of funds for the interbank market.

So this is a relapse into contraction. A sign that everybody bets on liquidity –which is actually just a trap. However, even though it is soon to know what will happen with these negotiations, the blockade is assumed.

On the other hand, other voices estimate that this threat is an opportunity to restore public deficit. That is the case of Daniel Lacalle, who claims that the chaos that is coming is the government’s fault.

This appreciation is somewhat incomplete and very biased because he doesn’t include the international repercussions. Besides, the US government has contracted –as illustrated here:

For now, the German bund (which had raised together with the US’s) has followed the same path than the American ones, and has also reduced its performance. This would announce a storm in markets –on both sides of the Atlantic- due to the preference for liquidity that diverts funds to the few existing tax havens.

Be the first to comment on "U.S. Government Shutdown: A Storm Pushes Through the Markets"