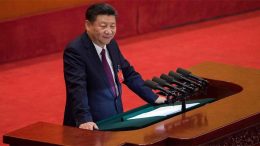

Third Plenum points to more muddling through but with more mud than ever

Alicia García Herrero (Natixis) | China’s long-awaited Third Plenum is finally over. Four days of high-level meetings (from July 15 to 18) among Party leaders ended with a perplexingly vague read-out of the meeting. The press conference on July 19 has not managed to assuage China watchers’ general impression of an uneventful gathering even if 300 reforms have been counted from official media but, reportedly, most of which already underway….