A boring 2024 for the Chinese economy would be a relief for the world

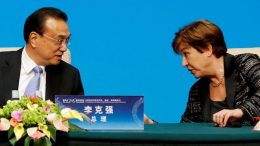

Alicia García Herrero (Natixis) | The years of China’s high growth are past, as the world learned painfully in 2023. Notwithstanding the enormous tailwinds stemming from having exited Zero-Covid policies during 2022, the Chinese economy barely reached the underwhelming 5% GDP growth target cautiously set by Premier Li Qiang back in March 2022. The reasons for the very slow recovery of the Chinese economy in 2023 are both cyclical and…