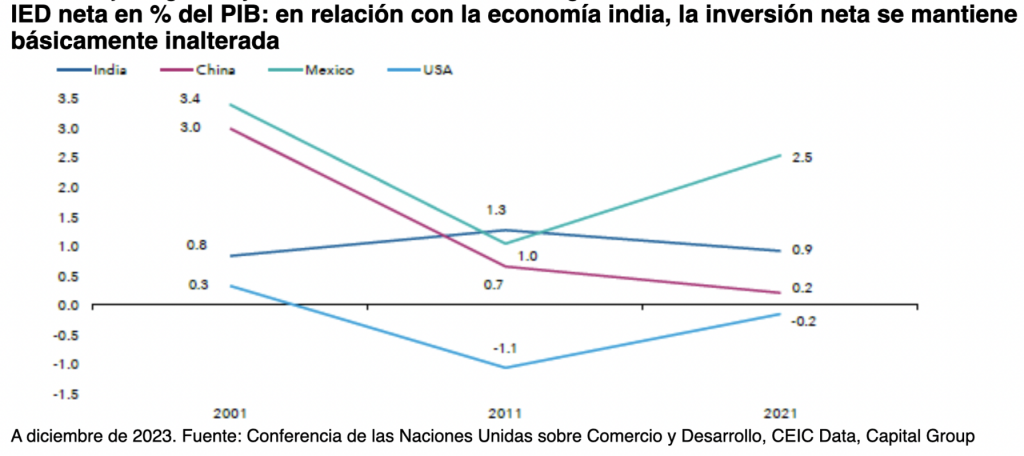

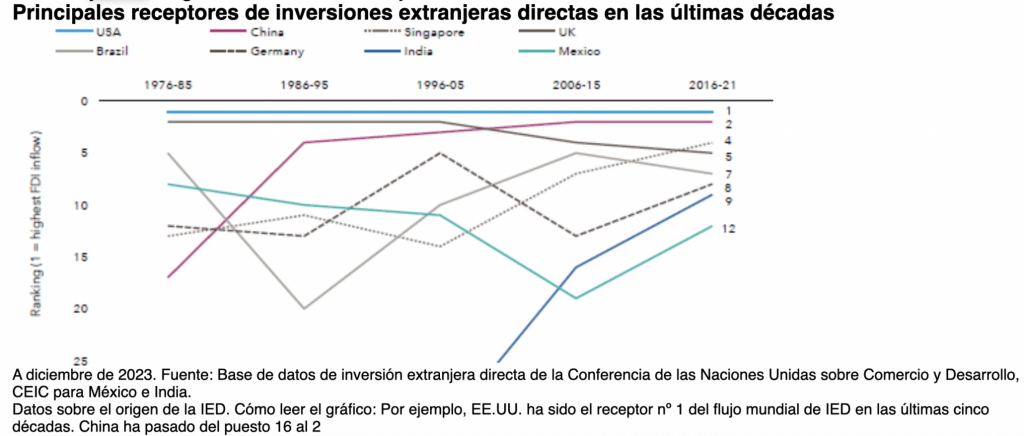

Global economyCapital Group| It seems that foreign investment patterns have yet to show a decisive successor to China. Globally, foreign direct investment (FDI) as a percentage of GDP peaked around the time of the financial crisis: investment in China stagnated slightly earlier, in the early 2000s, just after its accession to the World Trade Organisation and following rapid inflows into the manufacturing sector. In absolute terms, however, the United States and China continue to dominate global flows.

While India and Mexico show positive FDI trends, these are not (yet) sufficient to make them enduring strategic players.

India has underinvested in recent decades and, although FDI is coming in, net investment remains basically unchanged relative to the size of the economy. As the country continues to develop, we will watch flows, infrastructure development and cost improvements through better logistics and technology transfer from multinationals.