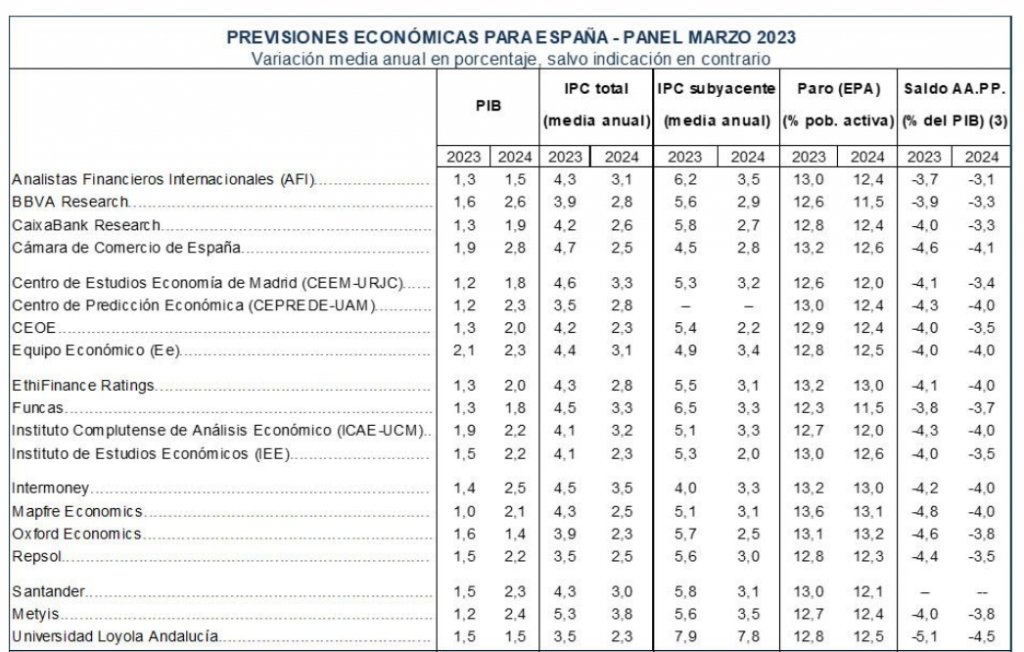

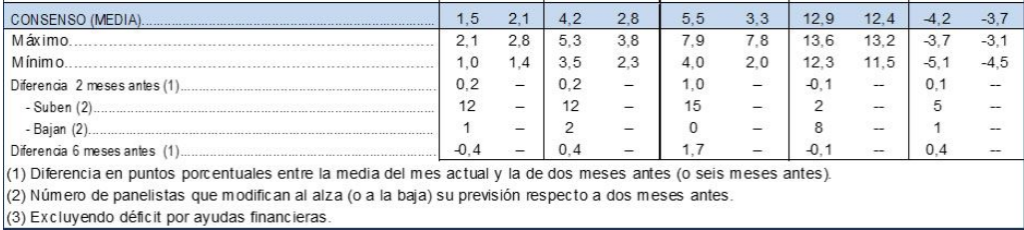

CdM | The Funcas Panel has revised its GDP growth forecast for this year upwards by two tenths of a percentage point to 1.5%, as a result of better-than-expected developments in recent months. For the first time, in this Panel, which closed before the current episode of financial instability, the projections for next year have been requested. The consensus for 2024 anticipates an acceleration of the economy by six-tenths of a percentage point to 2.1%.

As for the quarterly profile, the panellists expect growth of 0.1% in the first quarter and increases of around 0.4% and 0.5% in the following three quarters. The contribution of domestic demand will be 1.2 points, one tenth of a point less than the previous forecast, while the foreign sector will add three tenths of a point (compared with the zero contribution of the previous panel). The consensus has revised the forecast for growth in public consumption upwards and that of household consumption and investment in all its branches downwards.

In 2024, the contribution of domestic demand will reach two percentage points. Within this, public consumption will moderate, while investment and private consumption will regain momentum. For its part, the foreign sector will contribute one tenth of a percentage point to GDP growth.

The interruption in January and February of the moderation in headline CPI that began in September 2022 has led the panellists to raise the forecast for the average annual inflation rate by two tenths of a percentage point to 4.2%. For 2024, 2.8% is expected. For core inflation, the estimate rises to 5.5% this year and is expected to moderate to 3.3% in 2024. The year-on-year rates in December 2023 and December 2024 would be 4.1% and 2.3%, respectively.

The labour market continues on a positive note. The consensus forecast for employment growth is 1.1% in 2023 and 1.6% in 2024. The average annual unemployment rate will stand at 12.9% in 2023 and fall by five tenths of a percentage point to 12.4% in 2024.

The panellists foresee a reduction in the government deficit over the next two years. In 2023 it would stand at 4.2%, which is one tenth of a percentage point lower than in the previous Panel, and it would be 3.7% in 2024.

The external environment remains uncertain due to the persistence of inflation and the collapse of the US Silicon Valley Bank and its impact on the sector. Despite this episode, the consensus expects interest rates to rise to 4% in the second quarter of the year and to remain at that level until mid-2024. As a result, Euribor would peak in the second half of this year at 4%, to fall below 3.5% by the end of 2024.