Benjamin Cole via Historinhas | It is too bad in some regards that Richard “Inspector Clouseau” Fisher, the former president of the Federal Reserve Bank of Dallas, in no longer ensconced in that position. For one, he was always great copy. For seconds, he was one of the most infallible reverse indicators of Post War Era, and economic soothsayers could bet against a Fisherian proclamation with a rare calm.

Alack and alas, Fisher was replaced by Robert Kaplan in September, who so far seems content to avoid huge and regular public embarrassments.

Some may remember a jaw-dropping press conference Fisher held October 9, 2014 in the fair city of Dallas, where he proclaimed Texas wage inflation was a threat, soon to possibly envelop the nation—“there are concerns about getting it (wage growth) under control,” Fisher said. The former Dallas Fed Chief seemed especially agitated that wages were rising faster than prices, enough so to call reporters into his office.

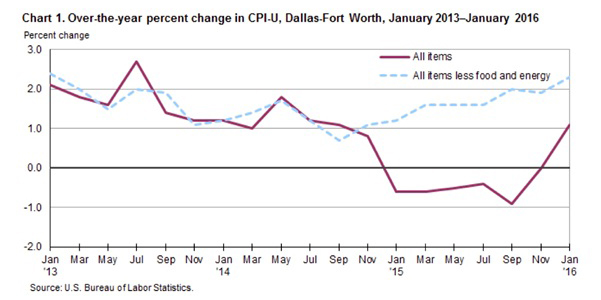

Well, as we see from the chart above, inflation, even as measured by the CPI (which tends to overstate inflation), Dallas sunk into deflation after the Fisher proclamation. Sheesh, the CPI for Dallas was headed south even as Fisher spoke. The chart for Houston, the Lone Star state’s other big city, looks much the same.

A Serious Lesson?

Okay, taking potshots at Fat-Target Fisher is always good for a laugh, but is there a more-serious lesson in all of this? Probably. Texas boomed and did not suffer inflation.

Now, some will say, “Oh sure, but Texas can import labor, capital and services from surrounding states.”

But the U.S. imports goods, services, capital and labor from the world. More demand would result in more supply. See Texas. Besides, global supply lines are glutted with product and commodities.

If a seven-year national recovery, magnified in the red-hot energy state of Texas, results in deflation in Dallas, should the U.S. Federal Reserve continuously go weak at the knees whenever unemployment skates near 5%?

Probably not.

P.S. Housing

Fans of Kevin Erdmann, author of blog The Idiosyncratic Whisk, know that Dallas is what Erdmann defines as an open city, one in which housing can be readily built. Many of America’s largest and glamour cities, such as Los Angeles, San Francisco, New York, Boston, Seattle etc., have criminalized robust housing construction. Not only those cities, but surrounding suburbs and towns—building high-rise condos anywhere along the Southern California coast, from liberal Santa Monica to conservative Newport Beach, is not done.

The U.S. economy has structural impediments, and housing is a big one. Still, the Fed may wish to ponder if suffocating the national economy to avoid some housing inflation is a good trade-off.