ECB bond purchases won’t be enough to reach €1Tr expansion

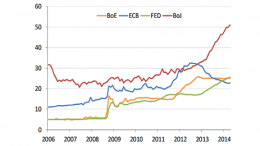

MADRID | The Corner | Regarding the corporate bond purchases by the European Central Bank, market watchers at Barclays consider that it won’t be enough to expand the balance sheet by €1trillion. Expert Alberto Vigil notes that, since investors are already buying corporate bonds, it doesn’t make much sense for the ECB to also purchase them, especially given the fact that asset risks are not exactly cheap. (Graph by Bruegel)