Today’s market chatter in Spain

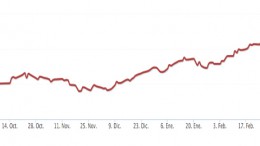

MADRID | By Jaime Santisteban | After the storm always comes the calm, and the dividend. Bankia’s Chairman José Ignacio Goirigolzarri revealed in the General Shareholders Assembly on Friday when first dividend will be distributed, probably in 2015. Restructuring plan (in record-breaking time) prevented the bank from doing so in 2014 and 2014. Reward wouldn’t just benefit small stockholders but also the State, that would get back part of the €22.4bn disbursed for BFA-Bankia bailout.