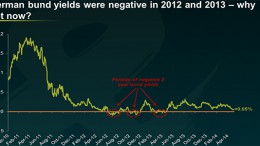

Morgan Stanley: “Bond markets will harshly react if the Fed mentions rising rates”

MADRID | By Julia Pastor | The ball is now on Janet Yellen’s court after BoE’s governor Mark Carney warned investors to get ready for interest rates’ hikes. What can we expect if the US Fed follows suit?