Jefferies Equity Research | Spanish Banks’ 1Q24 earnings season kicks off later this week. We expect focus to remain on the NII print/guidance in a context where rates expectations have moved up YTD. Loan growth still not helping, but in-check asset quality is an offsetting factor. Outside Spain, Mexico’s numbers came relatively solid into early Q1 24 as per CNBV data. In Brazil, loan growth is now flat in real terms and long-term real rates remain above expected levels.

- Supportive NII dynamics in Spain: While overall loan growth remains muted, we see some early signs of recovery in mortgages, alongside healthy growth in consumer credit, but subdued corporate lending activity. Solid margin dynamics; while we expect the cost of deposits to tick up slightly in the quarter, asset yields are supported by rates that are higher both against most banks’ and our own expectations. Overall we see 1Q24 consensus NII estimates broadly in the right place; these suggest NII is running at a stronger pace than implied by the 2024 guidance provided by banks at FY23 results.

- Cost progression on track, benign asset quality: We see Spanish banks well on track to hit their FY cost guidance. Agreements reached with the Unions recently were aligned with the industry’s original assumptions (c5% wage increase in 2024, and 3% p.y for following two years). Additionally, we see no red flags on asset quality, resulting from both low LTV mortgage portfolios and modest CRE exposures. Consumer credit, the riskiest lending pocket, is supported by both excess savings and the prevailing low unemployment rate.

- Key Latam profit centers: Mexican banks had a strong start to the year according to CNBV data; this was a mix of rising NIMs, no change in NPL formation and still healthy deposit growth/pricing (no signs of distress from recent deposit offerings by Fintechs). BBVA’s numbers in Mexico in Jan-24 looked particularly solid. One area to watch is Santander Mexico’s cost of risk on the credit card portfolio. In Brazil, comps are particularly undemanding for banks such as Santander Brasil, even despite both the credit quality and the rates’ trajectory are proving slower than expected. Expansion in valuation multiples in Brazil is proving to be a challenge, with the cost of equity, against all odds, increasing year to date.

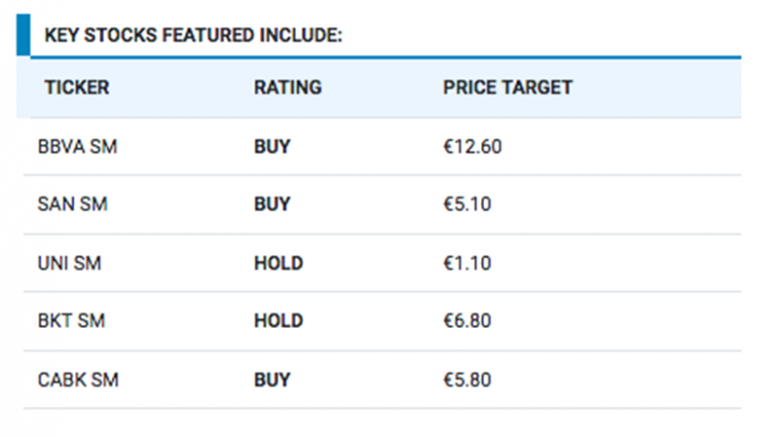

- Feedback from our initiation report: We published a note summarizing investor feedback from our recent meetings. Key topics included positioning in BBVA versus Santander, a constructive view building around domestic NIMs, potential M&A activity and the risk from digital disruption in Latam. The most discussed theme over the last few days is the potential shape that the Spanish banking tax could take following comments from the Spanish Government.