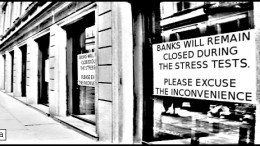

Reliability of Spanish banks is certified

MADRID | By Ofelia Marín-Lozano | The Spanish banking system got positive grades in the stress tests for two main reasons: the discrepancy between the accounts published by the end of 2013 and its (minimum) revision by the ECB’s inspectors. According to the asset quality revision (AQR), carried out before the stress tests, the capital ratio of the Spanish banks was only reduced by 20 bases points after the ECB’s revision. This is a minimum adjustment, slightly below the French or German banking system, but well below the Italian, Belgian or Dutch banking. It is certainly well below the big discrepancies detected in Greek and Portuguese banks.