Will the Bank of Japan act again?

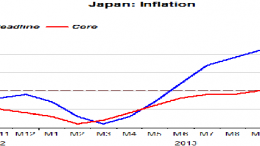

MADRID | The Corner | Will the Japanese Central Bank act again to raise inflation expectations and get inflation to reach its target of 2%? Some analysts believe the BoJ should allow the economy to overheat a little in order to promote higher inflation expectations. “Kuroda is convinced that the country will reach its inflation target of 2% in the FY2015,” experts at JP Morgan pointed out on Thursday, “but the help of the yen’s depreciation is fading since expectations of further monetary expansion are lowering too.”