Jefferies | A press leak earlier this morning seems to have unveiled renewed merger talks between BBVA (Buy) and Sabadell (Restricted). We provide some food for thought and outputs under different scenarios. We can see the merits for such a deal from the vantage of BBVA, but we remain expectant on whether both parties can agree on sensible terms. Our baseline scenario suggests 3.5% EPS accretion on just 20bps CET1 impact for BBVA.

Talking again? Following a press leak (here), BBVA (Buy) confirmed earlier today it is exploring a potential merger with Sabadell (Restricted). Sabadell later confirmed the receipt of a written merger proposal from BBVA, which is being analyzed as we write. Both banks were engaged in merger talks in 2020, but a deal wasn’t reached.

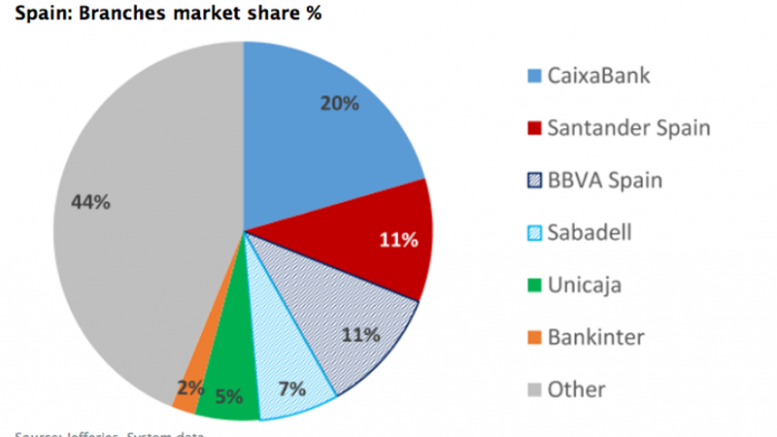

The hypothetical deal in a nutshell. BBVA and Sabadell run the third and fourth largest domestic Spanish banks networks respectively. Their potential combination would leave the new entity with a c19% share in loans, not far from CaixaBank (23.4%) and Santander (17.5%), the two market leaders currently. Sabadell has a larger relative exposure to SMEs whilst BBVA offers the most dimensioned/optimal platform where any Spanish retail business can sit longer-term. A combination of the two banks would somewhat tactically dilute BBVA’s exposure to EM also (from 77% of earnings to 66%, proforma). BBVA would also inherit Sabadell’s UK and Mexican businesses (€2.4bn and €0.9bn in equity respectively).

A proposed baseline scenario contemplates: 1) a 5% premium on Sabadell’s share price (9% premium d-1), 2) A 80%/20% paper/cash offer, 3) synergies running at 10% of the combined cost base in Spain, 4) Badwill from the deal converted into CET1. These assumptions would result on a 3.5% pro-forma EPS accretion for BBVA’s shareholders. Including restructuring costs of €1.1bn, BBVA’s resulting CET1 would drop by 20ps to 12.6%, implying a capital consumption of just €760m vs. pre-deal. We believe this is a reasonable capital deployment in exchange for a resulting c20% share in Spain, an instant uplift in its SME positioning and some tactical dilution of BBVA’s current EM exposure. We provide alternative scenarios; other things equal, a >20% premium (>25% d-1) for Sabadell would start to result in EPS accretion below 1.5% on a pro-forma basis.

What’s next?. The press leak clearly adds a layer of complexity for the deal to succeed, but it will certainly accelerate an outcome, either way. At the right terms, the hypothetical deal would not alter what we believe is still a compelling equity story at BBVA; we remain Buyers. Intra-market deals with some LT strategic legs can certainly work for shareholders at the right terms, and we are very comfortable with BBVA’s capabilities re execution and its LT vision of the banking business.