Federal Reserve: “Extended Insurance”

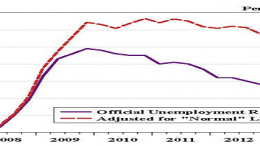

SAO PAULO | By Marcus Nunes | The Fed has never been comfortable with QE3; Many thought that QE ineffective; Bernanke felt compelled to clear the path for Yellen… But it has boosted “Forward Guidance” to make up (or more than make up) for the “taper”.