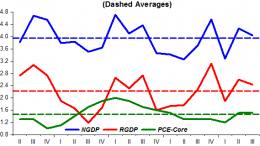

Accounting: US growth will (finally) pick up!

SAO PAULO | By Marcus Nunes via Historinhas | Why? According to the “accountants”: “It’s no secret that spending cuts (and tax hikes) have retarded America’s growth for the past four years. But data from the Bureau of Economic Analysis suggests that the era of austerity may finally have ended.” See the “flagship chart” above.