Draghi’s QE

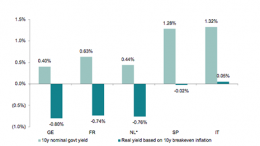

MADRID | March 10, 2015 | By Luis Arroyo | Six years after the Federal Reserve and the Bank of England launched their QE programmes, the ECB proceeded on Monday. Will Mario Draghi at least have the same partial success as his peers? That is, being able to slowly revive the economy and restore hope that the situation is getting back on track. In the graph above, see how five EZ governments are already borrowing at super low rates.