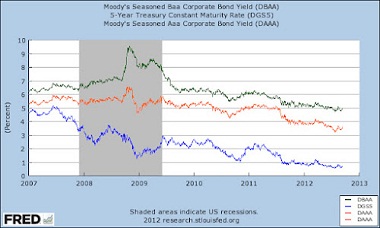

Here you are the chart on yields of US companies’ bonds, graded as triple A (in orange) and Baa (in green). It also shows the yields of 5-year US sovereign bonds (the blue lines. The graph collects daily data up to September 13, when Ben Bernanke announced that the Federal Reserve was about to engage in a more aggressive monetary policy.

All three indicators have broken barriers at the bottom, more or less since August 13, and all three have reached their lowest point since the crisis began. Bernanke has triggered some heavy moves.

And this will do for us in Europe some good, too.

It will multiply the Draghi effect. Any distension on the US dollar market will translate into better conditions for us. Bernanke is going to pump some $85 billion up every month into the markets and will keep interest rates at 0.25 percent until the summer of 2015.

It is a healthy push for stability and growth, and its expansionary waves will reach our shores. In fact, the European markets have already felt a certain recovery since the Federal Reserve disclosed its plans. Which is all well. Many of our austerity-obsessed economists will describe it as a scandalous situation, yet it is not.

In any case, no one can impede this Fed injections of cash to bring fresh air to Europe, the same way our austerity harms everyone else.

Be the first to comment on "Bernanke just broke down austerity barriers"