Bert Flossbach (Flossbach von Storch) | Delivery times for goods are rising worldwide due to a lack of intermediate products. The acute shortage of semiconductors, which are used in almost all devices, machines and cars, is causing particularly large problems for many companies. Ford therefore stopped production at its plant in Cologne until the end of October and Opel even stopped production in Eisenach until the end of the year. Mercedes could sell 200,000 more cars this year if the necessary chips were available, and BMW indicates it could sell up to 100,000 more. According to estimates by the German Association of the Automotive Industry (VDA), Germany will produce 2.9 million automobiles in 2021, 18 per cent below the weak figure for 2020 and a third less than the production recorded in 2019. Worldwide, around 10 million cars were not manufactured due to a lack of parts, according to estimates by the management consulting firm Boston Consulting Group, which would mean a loss of around USD 200 billion in sales.

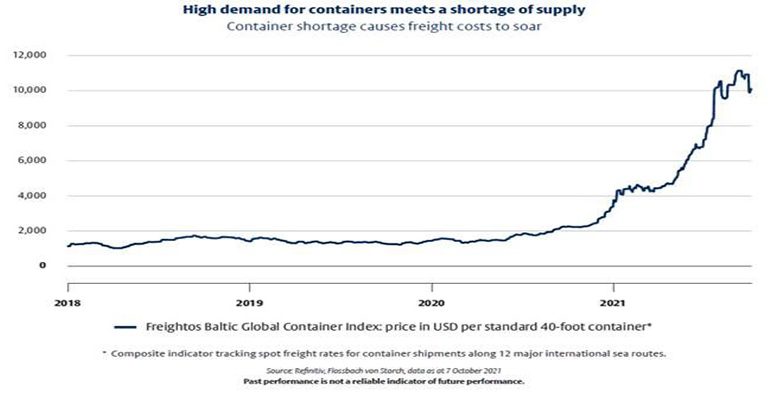

The cost of logistics has also risen dramatically. This year, for example, the freight rate for a standard container almost tripled to around USD 10,000 by the end of the period (see Figure). For the routes from Shanghai to Rotterdam and New York, the rates are even as high as USD 14,400 and 15,800, respectively, or around 10 times as high as before the pandemic. Another factor driving the increase in freight and logistics costs is a lack of truck drivers, which even led to supply shortages for petrol and long lines at petrol stations in England. This will likely lead to higher wages for truck drivers. There is also an increasing shortage of truck drivers in the EU and USA.

The USA has already recorded significant wage increases since the beginning of the year, especially in the low-wage sector. Newcomers to the retail sector are now being attracted with hiring bonuses and other benefits. The online retailer Amazon alone is looking for 125,000 new employees for its distribution centres and has further increased its minimum wage to USD 18.

These examples show that the current situation could last longer than originally thought. This is also indicated by information from the automotive supply industry, where the supply bottlenecks for chips and other intermediate products are expected to continue well into the coming year. Other sectors are also being affected by production limits in their supply chains.

The US sporting goods giant Nike is suffering from plant closures in Vietnam, where it has around half of its shoes and a third of its clothing produced. According to the company, 80 per cent of its shoe production is currently shut down and it will likely be months before operations are back to normal. The situation is similar for Adidas, although its share of production in Vietnam is somewhat smaller at around 30 per cent.