Is state backing mezzanine ABS worth it?

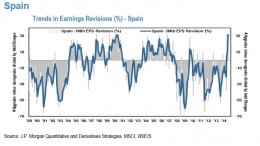

MADRID | By Julia Pastor | ECB’s upcoming ABS drive with senior, higher credit quality assets will be launched with or without guarantees from the states, that is for sure. The question is if countries will guarantee riskier tranches, the so-called mezzanine ABS. Spain is willing to do so if others go for it, yet Germany, France and the Netherlands are refusing. This makes sense since a state back up would mean to put assets with uneven exposure to bankruptcy on the same level. An eventual agreement would be a very difficult political decision. Details of the ABS plan will be announced after the central lender’s next monetary policy meeting on Oct. 2.