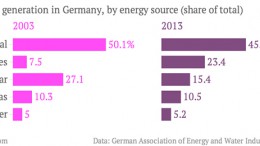

Industry wins in Germany’s energy transition

BERLIN | By Alberto Lozano | The German ambitious switch from nuclear and carbon-based energy toward renewables remains the biggest challenge for the first EU economy. The country’s industrial sector and consumers are worried about how much they will have to pay in terms of prices, competitiveness and jobs.