Who would be willing to buy sovereign debt with a risk premium over 600 basis points? Not many, but it takes all sorts. The case of Spain’s bonds in 2012 illustrates the question. Despite reaching a record high yield of 7.5% and being sold at a 88.6% its price, it fattened the portfolios of a good bunch of investors. It was a risky bussiness but they won more than 38%.

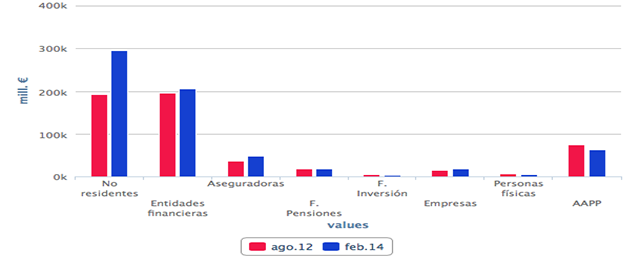

Following how Spanish debt investment portfolios developed in last two years it is posible to see that foreing investors, insurance companies and financial entities were the most interested in purchasing Spain’s government bonds at that moment of sinking.

Foreign investors increased over €100 bn their holdings on the country’s public debt, moving from €191 bn to current €295 bn. During the hardest times of Spain’s debt crisis in August 2012, their exposure climbed to almost €20 bn.

Insurance firms ranked second in the race of purchasing with Spanish investments rising by €12 bn in the last two years. The first €2 bn were bought just when the debt tide was at the highest.

Banks also increased their exposure by €10.8 bn thorought these years. However, fears of public debt’s importance on stress tests made financial entities to postpone sovereign bonds’ buyings to year 2013. That is the reason why they earned less than other investors.

Now that Spain’s 10-years bonds interests near 3% and price stands at 122.6%, ratings agencies are to revise the country’s credit in short. Fitch will announce its conclusions on Spain and Italy on Friday. In the meantime, Moody’s pointed out on Thursday that Spanish economy’s size, diversification and wealth as well as structural reforms would push up the country’s credit profile. Furthermore, the agency based its analysis on Spain’s economic, insitutional and fiscal strengths. They also underlined that Spain’s sovereign debt trends upwards regarding their peers in Europe. In fact, Ireland is likely to walk the same positive path, while Italy would lay on the other side of the balance.

The turning point for the rating agency to increase Spain’s rating would be a medium term reduction of its public debt which the firm expects to stabilize by 2016 or also an economic upturn over the foreseen 1.2% by 2014 and 1.7% by 2015.

Finally, Moody’s suggests the European peripheral countries will escape from deflation but not from a long period of low deflation. Spain could maintain its price index at 1.1% in the next four years.

Be the first to comment on "The juicy business of speculating with Spanish sovereign debt"