Care for a juicy Greek T-bone?

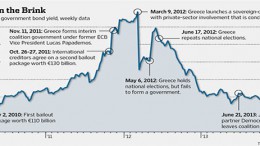

MADRID | By Julia Pastor | “Today we return to the bond markets after four years,” Greek Finance Minister Yannis Stournaras said on Thursday just before his country’s 5- years bonds matched analysts’ best expectations: €3bn over estimated €2-2.5 bn, with a demand around €20 bn and interest rates of 4.95% against foreseen 5-5.2%. As good food does, the auction is nourishing the twice bailed-out EU economy.