With the money Greece collected on Thursday after selling €3bn of five years public debt at 5% interest, the country’s government would have enough money to build a hospital or a school. At the moment, Greek leaders celebrate negative cliches about the country are near to dissappear. Is it right or wrong?

The progress of peripheral countries’ debt reaches today a new record high, with Spain’s ten years bonds yielding at 3.15%. This seems to be the key for Greece’s selling.

“The euro zone’s peripheral economies currently undergo a public debt boom. They are trendy again in foreing investors’ agendas after money coming from emerging markets has been questioned as a risky asset,” analyst at IG Markets Daniel Pingarrón explained. As a consequence, those countries’ ratio risk to benefit has significantly improved in last months.

Also having the support of ECB’s has become crucial for Greece’s external perception as well as the rest of southern euro zone’s.

“Greece’ s re-entry in capital markets proves an eventual stimulus program by the European central bank is more feasible than some months ago if growth or inflation figures were bust,” Bankinter analyzed.

“Inflation, more specifically low inflation, has also helped today’s Greek debt auction. As Pingarrón added, “with prices near deflation, their bonds yield easily climb to 5% near nominal rate, but if inflation touched ECB’s goal of 2%, yield would be then at 3%.”

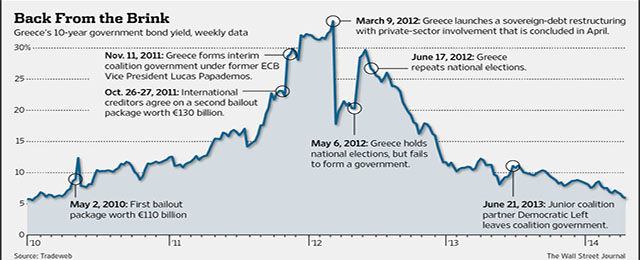

Greece’s financial recovery did not leave international market watchers unmoved, for better or for worse. According to Reuters’ economist Hugo Dixon, the country “is undergoing an astonishing financial rebound. The 10-year bond yield, which hit 30 percent after the debt restructuring of two years ago, is now 6.2 percent”.

Meanwhile, Kathleen Brooks at Forex’ traders points out that the appetite for Greek debt appears to challenge all fundamental logic: the country’s unemployment rate currently stans at 27.5%; prices are stranded in the middle of deflation; retail sales have been in red since 2010; Athens’ debt is still almost 180 percent of GDP, and S&P’s rating for Greece is six notches under investment grade.

Therefore, Greece’s successful return to markets could be considered premature, and additionally expensive.

“If the Greek sovereign is looking for best offers and has the objective of fiscal rectitude in mind, then the placement of a five-year, 2.5-billion-euro bond at a possible yield above five percent is rather highly priced,” independent analyst for southeast Europe Jens Bastian suggested.

Be the first to comment on "Care for a juicy Greek T-bone?"