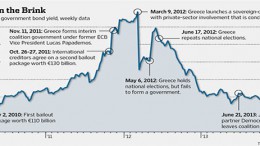

The Peripheral Countries’ Debt Moves To The Political Beat

The Eurozone is showing positive signs of growth and inflation. But the risk premium levels of the peripheral countries are still very high compared with those at the start of this year. In the short-term, they will move to the political beat, particularly any news on the French election.