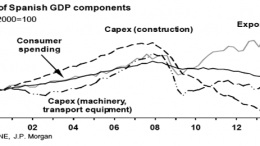

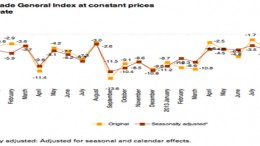

“Indeed, the worst is over in Spain…but still”

BARCELONA | By Joan Tapia| The crisis and recovery start management in Spain could be clearly improved. As a consequence, the economic confidence index stands at a gloomy 30.8 in December but have increased by 41% regarding 2012’ same month, while political sentiment is even lower at 27.1 and continues falling.