Why this turn? A year ago very few voices praised Spain’s steps.

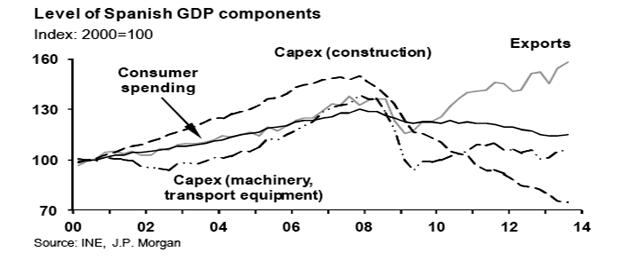

JPMorgan now believes the Spanish economy has “healed enough”, the report literally says, despite banks remaining reluctant to grant credits and the problems still hampering the construction sector. Domestic demand has improved, people consume more: a 1.6% increase. And so do companies, whose consumption rate rose by 3.2%. In addition, firms are still investing in machinery. The country is ultimately recovering its economic activity after a deep crisis that battered all productive sectors.

Another positive factor: the troika considered the banking sector bailout finished in 2013 and the exit has been praised as clean. The report said Spain’s banks were “well capitalized” and have improved their liquidity situation. However, they still must make provisions to cover bad loans and clean up their balance sheets.

A brighter picture that nevertheless still shows ugly spots, systemic problems: the indebtedness of the public sector, the lack of credit to companies that will not let them expand, and an over 26% unemployment rate that will hardly change in 2014. As JPMorgan puts it:

“The drag from weak bank credit and high lending rates to corporates will not fade quickly. But, we believe the available evidence suggests that there is sufficient dynamism in the economy to resume growth even in the absence of a significant improvement in financing conditions.”

Be the first to comment on "JPMorgan: “Spain is Back”"