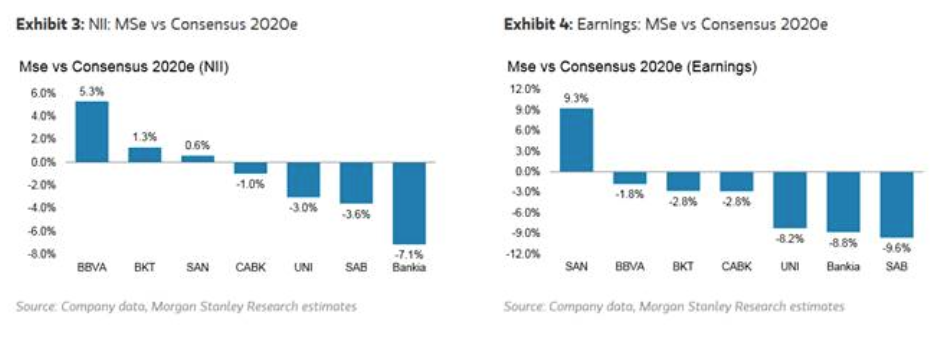

Morgan Stanley | We lower profit estimates for Spanish banks at an average 4.6-5% for 2020-2021 given the sensitivity of these to a further flattening of the rate curve as a result of a more dovish ECB. We highlight the following ideas:

Posibilidad de tensiones adicionales en NII si los tipos siguen bajando – los futuros ya lo están incluyendo en precios.

- The pressure on business models persists: Bankia and Unicaja are the two most sensitive banks, with the highest ROTE (5% by 2020) and lack of significant growth in sales, which makes us reiterate the short.

- Caixabank continues to have the best business model: We expect it to cover the cost of capital with a ROTE of 10% for 2020 thanks to its banking insurer model despite higher cost inflation. The trading line continues to be our top pick with a TBV of 0.8x by 2020.

- Santander is still our top pick – In an environment of sales pressures, the cost reduction target of 1bn, as well as the growth of its US division, can lead to benefits above guidance.