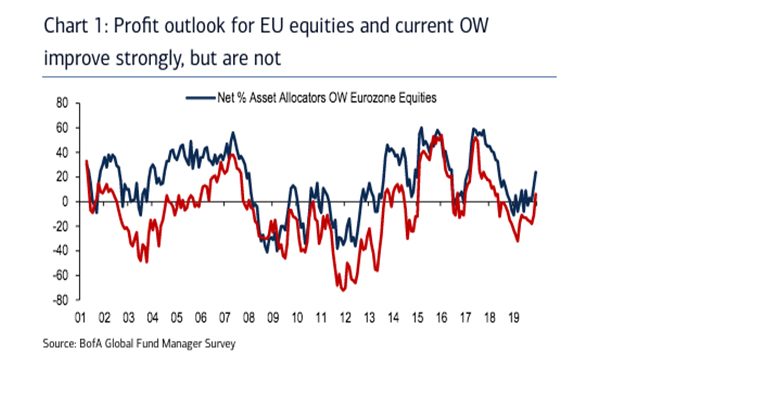

BofA | Investors are most bullish on equities in over a year. Global investors increase equities allocation to net 31% overweight, the highest level since Nov ‘18, on the back of improving growth, profits and capex outlooks. Within regions, EM tops with net 25% OW, Eurozone is second with net 24% OW, its highest since May ‘18. UK remains at the bottom, but its UW is cut to the lowest in 4 years. Our BofA EU Risk Appetite Indicator improves to +52 (range -100 to +100) on rising FMS inputs, failing to reach overbought levels as flows lag the optimism. We believe EU stocks offer further upside and extremes remain unexploited.

Conviction on lower inflation backdrop remains high and is visible in sector and style allocation. The largest improvements are in Quality-biased sectors: Financial Svs, Technology and Healthcare, while positioning in more cyclical ones: Basic Resources, Construction and Chemicals drops the most. The strongest style view, according to net 49% European investors, lays in High Quality outperforming Low Quality. We believe good Value strategies will outperform next year.