Data from the economies of most Latin America rank high in the reports of analysts covering the Spanish banking flagships. It is no secret that BBVA and Banco Santander have expanded their presence in those countries where historical ties with Spain have been translated into a successful commercial mating, particularly during the European crisis.

Companies in the energy sector, like Repsol, have dipped a foot, too, in American waters. The common language has proved as much an efficient plug for Spanish corporations as an insurmountable barrier for other European firms attempting to follow suit.

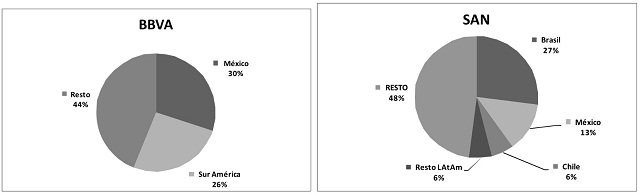

According to the entities' own calculations, Santander's rate of net profits via Mexico and South America has reached 52 percent of its total. BBVA's is even higher, 56 percent.

Sailing to the New Continent for fear of being dragged down by the euro zone market seems to have been a smart strategy. The average rate of the composite purchasing managers' index in the third quarter in the European Monetary Union was five points below the growth mark. Market expectations point at a GDP contraction of -1 percent, from -0.5 percent during the second quarter. Unemployment numbers were up by 34,000 people from July to September.

On the other side of the Atlantic, though, news is of a much brighter tone. Santander and BBVA would be pleased to know that the United Nations' Economic Commission for Latin America and the Caribbean has forecast a 3.2 percent GDP rise in 2012. The International Monetary Fund said Latin America's GDP would go up by 3.6 percent. Brazil's central bank said the country's economy would grow 1.6 percent. The Mexican government promises an economic acceleration of 3.5 percent to 4 percent. In Chile, the upward trend would be of 4.7 percent in 2012 and 4.5 percent in 2013, and of 4.8 percent in Colombia in the first quarter this year.

Nice amigos if you can get them.