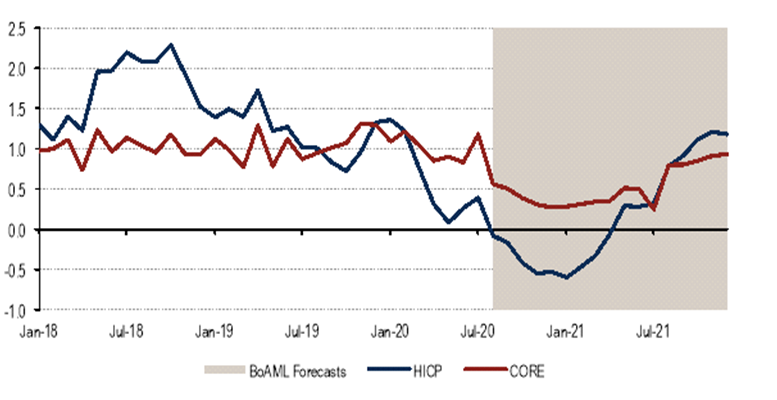

Rubén Segura-Cayuela (BoAML) | Reflation looks different: We keep reading with surprise that reflation is coming, and that inflation is around the corner. We could not disagree more. In fact, we cut again our already below consensus inflation forecasts. We now expect headline inflation of 0.2% in 2020 and 0.4% in 2021 (from 0.4% and 0.7%, respectively – Chart 1). Half of the downgrade is driven by core, which we now forecast at 0.7% this year and 0.5% next (from 0.8% and 0.7%).

The ECB will be busy

On balance, we would argue that downside risks to our forecasts dominate. Our alternative inflation measures almost exclusively signal lower core ahead. Upward pressures that had emerged in a Covid basket during lockdown have corrected lower again, too. Our inflation forecasts inform our ECB view. We still expect a top-up of the Pandemic Emergency Purchase Programme (PEPP) by another EUR500bn to stretch until end-2021- probably announced in December. That will be necessary to accommodate the economy. But it will not suffice to tackle long-term inflation dynamics and faltering expectations. More and longer policy support is needed, urgently.