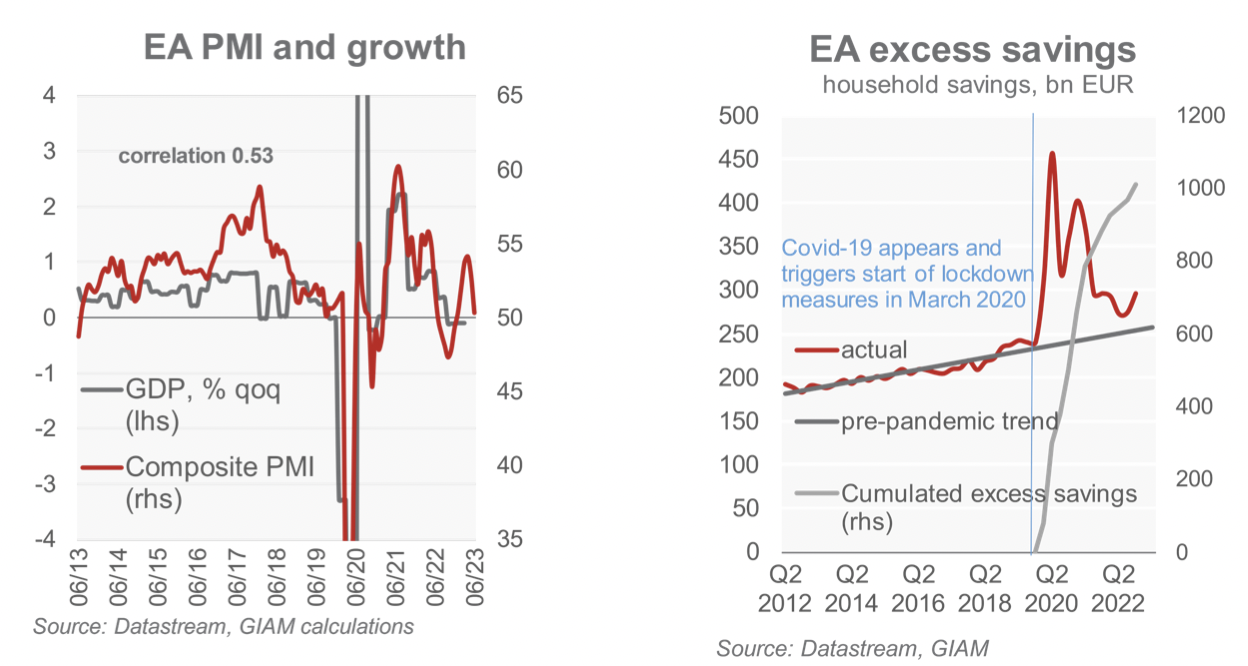

Martin Wolburg (Generali Investments)| The eurozone entered a technical recession during the winter half-year. However, indicators suggest that activity expanded again thereafter. Looking ahead to the second half of the year, however, we expect activity to moderate again, bringing the eurozone to the brink of recession. The main headwinds come from the global environment, which keeps manufacturing industry on a downward trajectory. At the same time, financing conditions will continue to deteriorate as monetary policy tightening takes its toll. In the eurozone, the more export-oriented economies, such as Germany and the Netherlands, are particularly affected.

We expect headline inflation to fall below 3% year-on-year, mainly due to lower energy prices towards the end of the year, and annual inflation to fall from 5.4% in 2023 to 2.5% in 2025. The labour market will remain tight (due to labour hoarding and the retirement of baby boomers), while wage growth will remain high. This favours domestic activity. In addition, there remains a huge savings surplus (of about €1 trillion) that could be used, at least in part. On balance, we still consider a recession strictly speaking more likely than a relapse into a technical recession, although we recognise that downside risks have clearly increased. Our forecast for output growth of 0.5% in 2023 and 0.6% foresees growth well below potential.

In June, the ECB raised its policy (deposit) rate to 3.5%, maintaining its hawkish tone. A further hike to 3.75% in July seems very likely. However, we doubt that the ECB will hike further. Core inflation will clearly remain too high, helped by strong wage growth. But, according to the ECB, there is little sign of second-round effects. And inflationary pressure is diminishing. Moreover, at the September meeting the ECB is likely to have to adjust downwards its hawkish outlook for activity, which assumes that growth returns to potential and remains at that level. We therefore believe that the ECB will adopt a “wait and see” stance after July, at least until mid-2024. That said, the risks remain tilted towards further hikes.