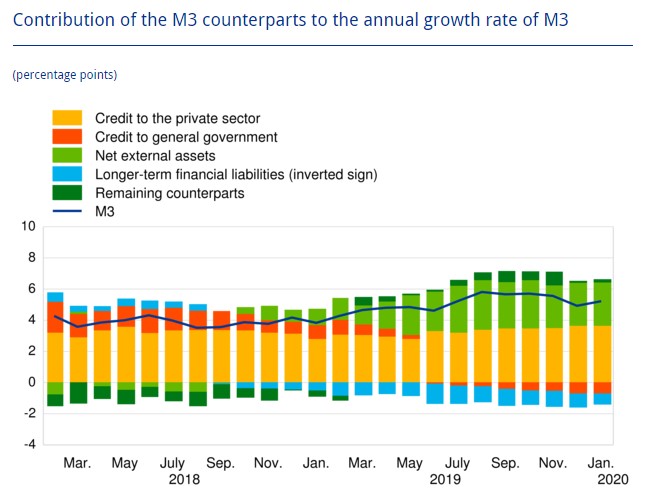

J.L. M.Campuzano (Spanish Banking Association) | The European Central Bank (ECB) published on Thursday the statistics for monetary aggregates in January. Growth in the M3 money supply continues to exceed the theoretical level compatible with medium and long-term inflation of 2%. In January specifically, the growth rate accelerated to 5.2% per year. The main contribution was from credit to the private sector, with an increase of 3.4% over last year. The component related to bank loans accelerated its rate of increase to 3.5%.

Another interesting indicator contained in the statistics is that related to deposits. European families’ deposits increased 5.5%, with more than a 6.1% rise in corporate deposits. Public sector deposits grew by up to 5.7%

Spanish families’ deposits continued to rise in January, with an annual increase of 4.9%. Deposits continue to capture the interest of European families, who are looking for security and confidence amid the current uncertain environment . At the same time, the banks are acting as a containment barrier for families from the negative interest rates applied by the ECB itself.