Central banks play a crucial role in the current economic and financial scenario. Under the premise of securing financial and economic stability, monetary authorities are making their policies clearly expansionary, based on the use of various instruments of an extraordinary and innovative nature.

At the same time, to reinforce the results of their actions and ensure they last, central bankers are also relentlessly calling for a contribution from political leaders in the form of ambitious structural reforms and far-reaching fiscal adjustments. This is clearly the case of the euro area and of the United States.

During the months of July and August, the actions of the European Central Bank (ECB) have occupied a large part of the headlines in global financial markets. The exceptional rise in the sovereign risk premium for several countries on the periphery and the deterioration in growth prospects for the region have led the ECB Council to adopt particularly significant measures.

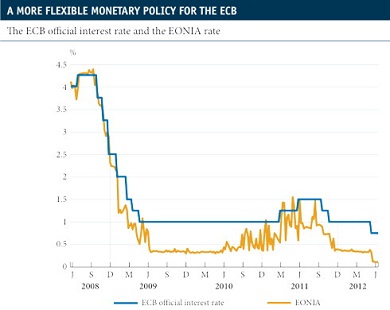

Of note among these, firstly, is the historical lowering of the official interest rate to 0.75% and the deposit facility interest rate to 0%. With both cuts, the ECB's aim is to relax general monetary and financial conditions, improving the efficiency of the mechanisms to pass on credit in the euro area.

By lowering the official interest rate, it hopes to reduce financing costs in the long and medium term, while the reduction in the deposit interest rate aims to boost interbank market activity.

The second significant measure has been the announcement of the ECB's official position regarding its intervention in the debt markets for peripheral countries. This has been a key debating point over the last few months and the confused communication policy of ECB President, Mario Draghi, has had considerable impact on global markets. In principle, and as part of an unofficial conversation, Draghi made the following statement on developments in the euro area crisis: «Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And, believe me, it will be enough.»

Financial markets reacted immediately to his words, setting off a process of narrowing spreads for Spanish and Italian sovereign debt compared with Germany. But this optimism didn't last long. After the regular meeting of the ECB's Governing Council, Draghi stated that there are strict conditions for the ECB's actions.

Specifically, the institution will be prepared to buy up countries' sovereign debt provided their governments have previously asked for help from the current European bail-out fund (EFSF/ESM). He also said that, should they intervene, the sovereign debt purchases would focus on the short part of the curve; in other words, maturities of between 1 and 3 years.

Although this has brought about a considerable reduction in yields on Spanish and Italian 2-year bonds, it has not been well received by most observers who believe that certain aspects still need to be spelled out, such as how much debt would be bought and under what terms it will interact with the EFSF/ESM.

In any case, the ECB continues to encourage governments in the euro area to adopt the necessary fiscal and structural measures to achieve a greater degree of stability and competitiveness. For its part, the ECB has undertaken to collaborate in designing and implementing the route map for «banking union», which would include the creation of a single supervisory bank and the possibility of giving bail-out funds more flexible powers.