CaixaBank Research (Oriol Carreras Baquer and Javier García Arenas| The 2008 financial crisis is still fresh in the collective memory. However, the 2020 crisis is of a very different nature. For starters, the crisis has originated from a health emergency, so the economy has been the victim of the measures needed to tackle the pandemic. Secondly, the COVID-19 crisis has been of an unprecedented magnitude. Whereas at the height of the 1993 and 2008 crises GDP fell to 2.5% and 9% below the pre-crisis level, respectively, during the COVID-19 crisis GDP has reached 22% below the pre-crisis level. Thirdly, the dynamics have also been very different. To the extent that COVID-19 has been the trigger of the 2020 crisis, the economy has evolved according to the fluctuations of the pandemic. Thus, the speed of the recovery has been much quicker than in previous crises. In 2020, in a single quarter (Q3) the economy recovered almost 60% of its lost output, compared to the nine quarters it took during the financial crisis.

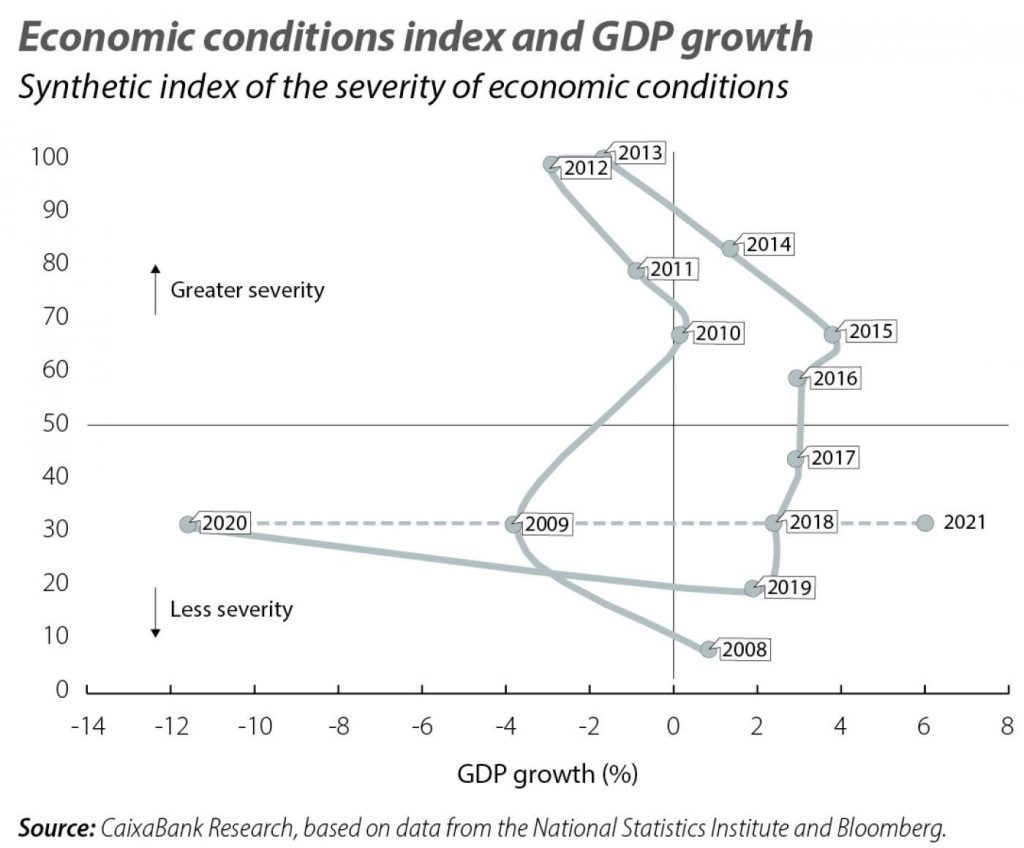

Another feature of the current crisis has been the key role played by monetary and fiscal policy in alleviating the effects of the pandemic. To illustrate this, in the first chart we show the relationship between a synthetic index of the severity of the economic conditions (built using the unemployment rate and the sovereign risk premium) and annual GDP growth.

The large drop in GDP has been accompanied by a much smaller deterioration in the severity index than one might have expected given the experience of the financial crisis. This has largely been due to the decisive action of the ECB and all the actions taken by fiscal and economic policy to secure the incomes of those affected by the restrictions on activity, whether through Spain’s «ERTE» furlough schemes, extraordinary temporary cessations of activity in the case of self-employed workers, debt moratoriums or tax deferrals.

This does not mean that we have already seen all the implications of this crisis: many are yet to emerge, and we will refer to them later. However, to use a health metaphor, economic policy has acted as an anaesthesia to stabilise the vital signs of a patient entering the critical phase.

What will 2021 bring us?

2021 will continue to be dominated by the pandemic, although it is expected to be the year in which the economy will consolidate its recovery. The measures that had to be taken at the end of 2020 to combat the second wave of infections are likely to have some continuity in the first few months of 2021. However, we are confident that the availability of a vaccine, together with more intensive use of rapid tests, will allow the pandemic to be kept under control without having to resort to measures as restrictive as those imposed to date. In this regard, we expect the growth of economic activity to pick up from Q2, when the highest-risk groups should already have been immunised, while international mobility should enjoy a stronger recovery, with the resulting positive impact on tourism.

Overall, we expect economic growth in 2021 to be around 6.0%. While the pace of recovery is high, this would still leave the economy 6.2% below the pre-crisis GDP level. In fact, we do not expect the economy to return to pre-crisis levels until 2023.

The economic scars of the Covid-19 pandemic

The economy will recover over the next few years at the macroeconomic level, but it will leave some major scars. It will therefore be essential to pursue appropriate economic policies so that these scars can be closed in the shortest possible time and to avoid persistent effects in certain economic sectors and for those who work in them.

The labour market will gradually recover in 2021, although labour policies will have to accompany this recovery in order to prevent the sectors hardest hit by the pandemic – tourism, leisure, hospitality… – from emerging with deep scars. Thus, furlough (ERTE) schemes will remain an important tool in the first half of 2021, albeit in a more selective and temporary manner than in 2020.

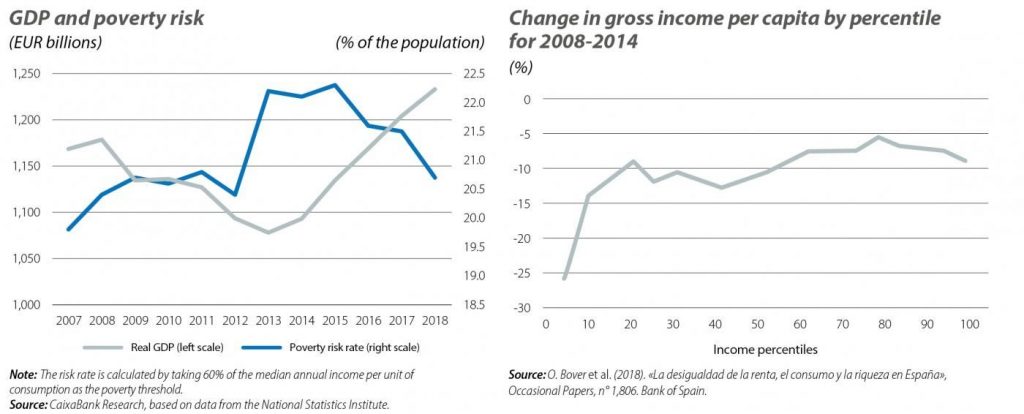

Another scar that ought to be closed quicker than in the Great Recession is the rise in inequality. Sometimes the consequences of crises take time to emerge at the social level: the percentage of the population at risk of poverty in Spain rose significantly between 2013 and 2015, just as the worst of the previous crisis had already passed and the economy was embarking on an incipient recovery. In fact, based on our forecasts for growth and unemployment, we see that the sum of the poverty risk rate and the social exclusion rate could increase in 2021 to 27% of the population (25.3% before the pandemic), an increase of 750,000 people. This highlights the importance of continuing to develop inclusive policies that allow the recovery to reach everyone: in 2020, the Gini index increased by 2 points between February and September taking into account public sector transfers, but it would have increased by 4 points in their absence, according to CaixaBank Research’s Inequality Tracker.

2021 will also be an important year for the Spanish economy’s productive fabric. It is essential that Spanish firms do not emerge excessively weakened from this pandemic. This will require a combination of financial relief for viable companies that are hardest hit in order to ensure that their solvency does not deteriorate – for instance, via recapitalisations and direct aid – together with structural policies that adapt the productive fabric of the economy to a more digital and green post-pandemic world.

Finally, it will be essential to combine a fiscal policy that offers support for the short-term recovery with a medium-term vision focused on rebalancing the public accounts and recovering some fiscal margin to ensure that the next crisis catches us with room to pursue counter-cyclical policies.

The hope of the NGEU European funds

The European Recovery Fund, Next Generation EU (NGEU), will represent a unique opportunity to modernise the Spanish economy and boost its potential growth. In 2021, Spain will submit the full details of its Recovery Plan to the European Commission and, after its expected approval, will begin receiving funds mid-year. These funds will total some 72 billion euros in non-reimbursable transfers between 2021 and 2026, equivalent to 5.8% of GDP in 2019. This is a very significant amount and it is key that the funds are used to design an intelligent investment plan focused on infrastructure and the green and digital transitions, accompanied by reforms that address the structural challenges of the economy (the incidence of temporary contracts in the labour market, education and vocational training, innovation, etc.).

The government expects to execute 26.6 billion euros of NGEU funds in 2021 by anticipating the budgeted funds in order to accelerate the planned investments. This is a considerable sum which, prior to its execution, would require the selection and design of a large number of projects in record time.Being conservative, our growth forecast for Spain next year incorporates the execution of 50% of this sum of 26.6 billion euros, which would contribute 1 point to next year’s growth.

The European funds are big news, but it is worth looking at what macroeconomic impact fiscal policy as a whole (including these European funds) will have in 2021.When we perform this analysis, we come to a total fiscal boost in 2021 of around 2.5% of GDP with a macroeconomic impact of 1.5 pps, comprising 1.0 pp resulting from NGEU and the rest from current expenditure. In short, the European funds are the catalyst that will enable economic policies to stimulate economic growth in 2021 (and beyond).