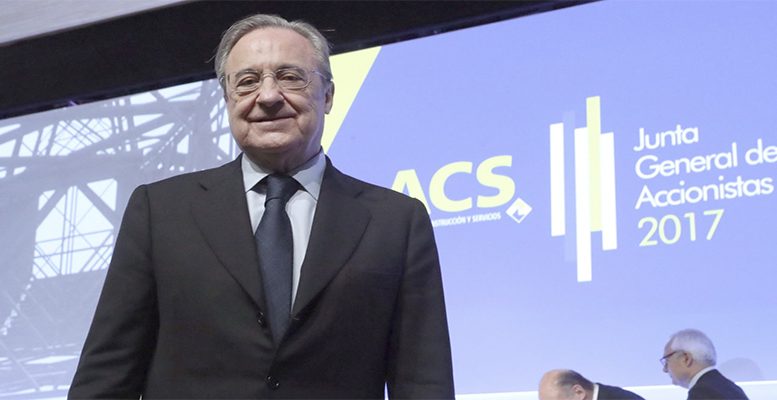

Intermoney | On Thursdsay after the market’s close, ACS (ACS) (Buy, Target Price 40 euros) registered its forthcoming AGM announcement with the CNMV. The meeting will take place on May 6 at second call. Whatsmore, the construction firm also made public its board’s proposals, which envisage an issue of new shares worth up to 600 million euros. This is a traditional move to make a dividend payment, and the capital hike could happen in various stages, but always before the end of Q1 2023. ACS traditionally pays an interim dividend in February, which stood at 0,47euros, corresponding to 2021, and a final dividend in July (1,27 euros in July 2021, corresponding to 2020).

Valuation. We will see what the July final dividend figure is, but ACS’ chairman already announced that he expects to consolidate an annual amount of over 2 euros/share from here on in. This is a figure which the company came close to in 2019. The 600 million euros capital hike will more than cover this amount. After closing 2021 with net cash of over 2 billion euros, we believe this objective is fairly accessible. These amounts imply a return of close to 8%, which obviously makes the stock attractive as a dividend play, as well as for its potential for revaluation (+63%). If we add to that the potential catalyst of a reorganisation in the Group, already in motion with the purchase of Cimic’s minority interest, we believe it is more than justified to include ACS in our model portfolio.