BBVA maintains the same conditions that it offered to the board of Sabadell (SAB) and that the latter rejected, so now “the ball is in the court” of the shareholders of Sabadell (SAB), who will determine whether the operation goes ahead or not. BBVA shares received the news with declines of 5% while those of Sabadell (SAB) rose 4%.

As Jefferies pointed out in its analysis of the offer, “Despite the premium, numbers work for BBVA”:

The offer implies 30% premium over Sabadell’s share price as of the close of April 29th (equivalent to €2.26/share or 1.0x P/TNAV), in an all-paper deal.

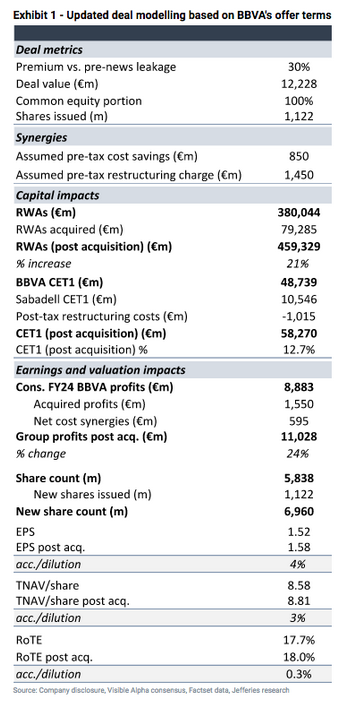

The deal implies c4% EPS enhancement and a 30bps capital cost for BBVA, in line with our baseline published yesterday (3% and -20bps respectively) as the higher premium (30%) is offset by larger cost synergies (€850m versus our €550m estimate). Deal logic is sufficiently clear and valid for us.

BBVA claims the deal is expected to lead to c3.5% and 1% accretion on EPS and TNAV respectively for a modest 30bp CET1 cost, and without impacting the group’s current shareholders’ remuneration plans. The integration of both banks in Spain is expected to produce €850m in pre-tax annual cost savings, for an upfront pre-tax restructuring charge of €1.45bn.

While we estimated a similar EPS and CET1 impact (3.3% EPS accretion, 20bp CET1 ratio hit), the offer is richer in price and involves 100% equity (we assumed 20% cash). The €850m gross cost savings target is 55% higher than our initial estimate (€550m), implying 16% of the combined cost base (and 40% of Sabadell’s domestic cost base). Exhibit 1 presents our updated math based on the disclosed financial terms. We note there might be further impacts such as 1) some revenue attrition from overlapping clients, 2) FV adjustments taken in relation to the loan portfolio, 3) a hit from unrealized losses on the fixed income portfolio, not deducted from Sabadell’s CET1, 4) some capital benefit from Sabadell suspending its ongoing share buyback (already deducted from Sabadell’s CET1 – similar to witnessed with NationWide/VMUK). Without considering the net of those effects, we reach a 4% EPS accretion (versus 3.5% est by BBVA), a 3% TNAV accretion (+1%), and a 15bp hit to CET1 (-30bp).

The potential combination of BBVA and Sabadell would leave the new entity with a c19% share in loans, not far from CaixaBank (23.4%) and Santander (17.5%), the two market leaders currently. Sabadell has a larger relative exposure to SMEs (c33% of the total lending portfolio, and an estimated market share in SME lending of 13%) whilst BBVA offers the most dimensioned/optimal platform where any Spanish retail business can sit longer term in our view. A combination of the two banks would somewhat tactically dilute BBVA’s exposure to EM also (from 77% of earnings to 66%, pro forma). Put shortly, deploying capital to buy Sabadell at 1.0x P/TNAV looks sufficiently attractive post synergies, it would tactically trim BBVA’s EM profile and would not alter its shareholder remuneration plans significantly.