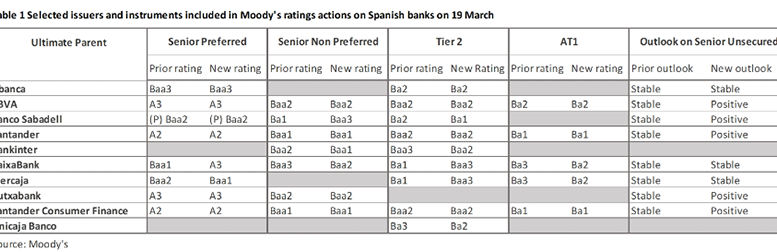

Moody’s has revised some ratings of 15 Spanish financial institutions following its assessment of “an improvement in operating and credit conditions in Spain, which has implied the upgrading of Spain’s macroeconomic profile to strong”. The decisions also take into account the revision of Spain’s rating outlook from stable to positive on 15 March. The agency upgraded the senior preferred ratings of CaixaBank and Ibercaja and revised the outlooks of several Spanish banks.

Moody’s explained that its upgrade of Spain’s Macroeconomic Profile reflects “an increasingly favourable operating environment, as well as improved credit conditions, which are having a positive impact on the standalone credit profiles of Spanish banks”. The rating agency’s analysis takes into account that the “substantial” improvement in credit conditions in Spain has been marked by the reduction in debt held by the private sector and incorporates the expectation that “debt servicing costs for Spanish borrowers, which rose sharply in 2023, will decline in 2024 as market rates continue to fall from the peak reached in September 2023”.

Their analysis also takes the view that “the solvency of Spanish banks is supported by good general funding conditions, underpinned by a large and stable customer deposit base that covers most of the banks’ funding needs”.