Alicia Garcia Herrero & Jianwei Xu (Natixis) | Chinese economy ended 2022 by growing only 3% YoY, with the last quarter GDP slowing further to 2.9% YoY. The figure was finally much lower than the target set during the Two Sessions by the Chinese government mainly because of the heavy mobility restrictions imposed under zero-Covid policies since the Shanghai lockdown.

The slowdown in Q4 was particularly reflected in the decelerating consumption growth during October and November. However, the last month of 2022 which experienced an unprecedented Covid-19 outbreak was actually significantly better than November. Specifically, China’s retail sales grew less negatively in December from -5.9% YoY in November to -1.8% YoY. The key factor supporting retail sales was the strong demand for medicine, followed by autos. But because of the Covid-19 outbreak, the demand for catering services continued to fall from -8.4% YoY in November to -14.1% YoY in December.

Another important blow to the Chinese economy was weakening investment. China’s year-to-date fixed asset investment slowed from 5.9% YoY in September to only 5.1% YoY in December. In particular, the year-to-date property investment slumped to -10% YoY in December from -8% YoY in September despite the government’s easing of regulatory policies on the property market. While the government continued to bolster infrastructure investment, whose year-to-date growth rate accelerated from 8.6% in September to 9.4% in December, Chinese investor’s sentiment remained stagnant in December.

China’s manufacturing sector, which had remained rather resilient during the first three quarters of 2023, also decelerated rapidly during Q4. The year-to-date manufacturing investment growth slowed significantly from 10.1% at the end of Q3 to 9.1% in December 2022. The weakening manufacturing activity also echoed China’s falling exports, whose growth rate decelerated rapidly from 5.7% YoY in September to -9.9% YoY in December. While China’s imports also decelerated, it was moving at a slower pace comparing to exports, causing China’s trade surplus to decrease from $265 trillion to $232 trillion.

In terms of economic policies, while the fiscal supported infrastructure projects continued to strengthen investment, China’s monetary policy seemed to have become increasingly careful. The PBoC has cut the RRR by 25 bps in December, but it has not changed the loan prime rate (LPR) at the end of the year. In the interbank market, the 3-month SHIBOR, has increased significantly from 1.67% on September 30th to 2.42% on December 30th.

On the financial market, investors have already started to price in the future of China’s reopening. From the end of October to January 16th, Shanghai composite index has surged by 11.6%. At the same time, China’s CNY has also appreciated sharply from 7.3 to 6.7.

Stepping into January 2022, Chinese economy has shown more signs of economic recovery. Our calculation shows the inter-city GPS based mobility significantly increased stepping into early January in 2023. The number of flights and ships in major ports have also recently rebounded. While the intra-city metro mobility was still relatively lagged, the situation is also expected to recover if the Covid-19 situation continues to stabilize.

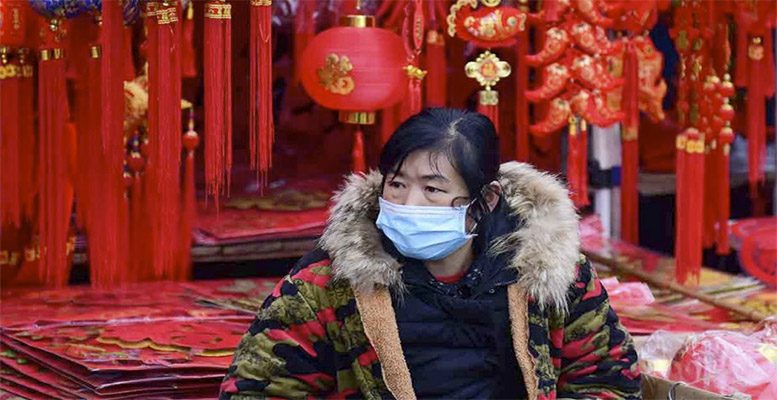

Moving forward, we expect consumption of mobility-related services, especially tourism and hospitality, to see the most immediate support from the easing of Covid-19 rules. Beyond that, housing transactions are also likely to improve due to the pent-up demand and the more favorable base effect. There are, however, some lingering concepts. First, manufacturing activity may remain sluggish, echoing the weakening global demand. Second, investor sentiment could take long to fully recover, especially for foreign direct investment. Thirdly, the structurally dragging factors, such as population aging, will continue to affect China’s potential growth rate. Overall, we are cautiously optimistic about China’s recovery after the Chinese New Year. In particular, we expect the Chinese economy to enjoy high growth during Q2 2023 thanks to the favorable base effect. Overall, we expect China’s GDP to grow 5.5% for the whole year in 2023.

China ended 2022 on a gloomy note but reopening will save 2023