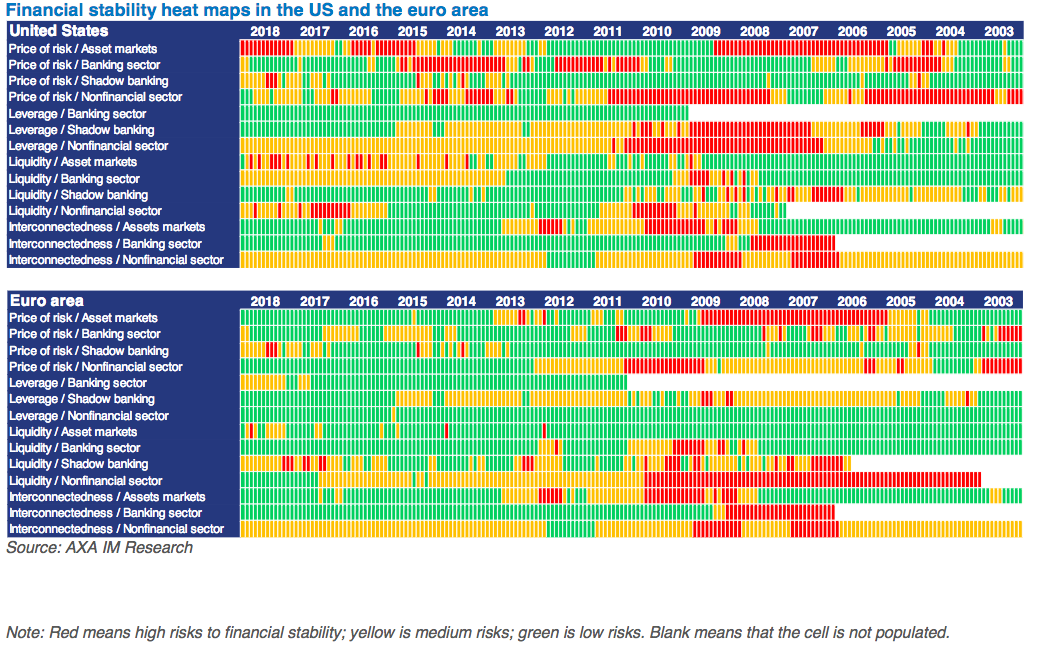

In terms of AXA IM financial stability indicators for the US and the Euro zone, we have found that risks are moderate overall , and stable, compared to six months ago albeit relatively higher in the US.

Unsurprisingly, the US exhibits relatively more risks compared to the euro area, with one red flag in particular being the price of risk in asset markets reflecting elevated asset prices across fixed income, equities and real estate. In the Euro zone, risks look mor e modest except in some pockets related to price distortions as a result of the European Central Bank ’s quantitative easing strategy.

Even so, our tool may be understating overall financial stability risks in both regions. In the US, many market developments that we may have to deal with in the coming years represent unchartered territory e.g. exit of central banks’ balance sheet policies, behaviour of index investors in stressed environments and the rise in international and infra -national inequalities , with possible consequences on both politics and policy .

In the euro area, the main risk for financial stability may not be captured here as it lies with the sovereigns. Public debt remains high and the next crisis will most likely be met with even less fiscal headroom than in 2011 – unless a federal fiscal capacity is created by then- and the ‘doom loop’ between sovereigns and banks is yet to be broken.